Motilal Oswal Financial Services has launched its maiden public issue of non-convertible debentures (NCDs) worth Rs 1,000 crore, comprising a base issue of Rs 500 crore and a green-shoe option of Rs 500 crore to retain oversubscription.

The debt issue will be available for subscription from April 23-May 7, 2024. The NCDs will be listed on BSE and NSE.

The NCDs will attract a coupon rate ranging from 8.85% to 9.70% based on the series investors opt. The NCDs will have tenors ranging from 24 months to 120 months. The company will pay interest on monthly, annually or cumulative basis. Of the issue size, 10% will go to institutional investors, 10% to non-institutional investors, 40% to HNIs and 40% to retail investors. The allotment will be finalized on “First Come – First Served” basis.

In the Series 5 category of NCDs, which has a tenure of 60 months or 5 years, the debt instrument will carry a coupon rate of 8.97%, and effective yield would be 9.35%.

A coupon rate refers to declared interest rate payable each year and yield means the actual return an investor gets from the debt instrument for a year.

Motilal Oswal Financial Services NCDs objective:

The company will use at least 75% of proceeds from NCDs for meeting working capital requirements and repayment of existing liabilities. Another 25% will be utlised for general corporate purposes.

NCDs credit rating:

The NCD issue is rated CRISIL AA/Stable by CRISIL Ratings Ltd and IND AA/Stable by India Ratings and Research.

Debt instruments bearning these ratings are considered to have high degree of safety in terms of timely servicing of financial obligations.

Note: This rating is not a recommendation for investors and they must take their own call regarding this.

Tenors and coupon rates:

The company is offering coupon rates of 8.85%, 9.10%, 9.35% and 9.70% on tenors of 24 months, 36 months, 60 months and 120 months, respectively.

Motilal Oswal Financial Services NCDs Vs fixed deposits

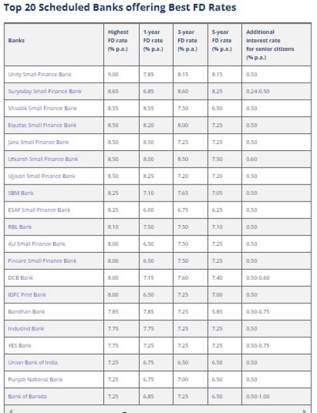

The 9.7% interest rate p.a. on NCDs with 10-year tenure comfortably beats high-paying fixed deposits. Amongst all bank categories, small finance banks offer comparatively higher rates on fixed deposits.

Source: Paisabazaar.com

Among the scheduled small finance bank category, Suryoday Small Finance Bank is currently offering an FD interest rate of 8.25% p.a. for general customers on a five-year fixed deposit, while senior citizens are given up to 0.5% extra interest on the FD of same tenure.