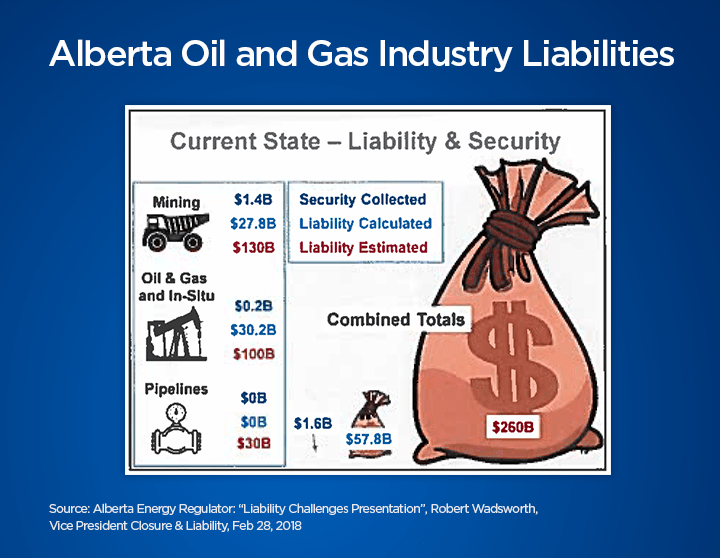

Cleaning up the Alberta oilpatch could cost an estimated $260 billion, internal regulatory documents warn.

The staggering financial liabilities for the energy industry’s mining waste and graveyard of spent facilities were spelled out by a high-ranking official of the Alberta Energy Regulator (AER) in a presentation to a private audience in Calgary in February.

The estimated liabilities are far higher than any liability amount made public by government and industry officials.

The official, Rob Wadsworth, vice-president of closure and liability for the AER, says a “flawed system” of industrial oversight is to blame.

He called on all stakeholders to accept tougher regulations and move away from a system that now allows the largest companies to take centuries to clean up their toxic well site graveyards.

WATCH: Global News coverage related to oil prices over the last few years.

“We can continue down our current path until the impacts are felt by the public … or we can start to implement the numerous changes that we now know need to be made,” the document says, adding that the liabilities are underfunded and the collection of security funds from industry is “insufficient.”

LISTEN BELOW: Amin Asodallahi with Horizon Advisors speaks with 630 CHED

Until now, the public has been told the liabilities have been calculated at about $58 billion, far less than Wadsworth’s estimate. The report does not spell out what he based his estimate on and Wadsworth declined an interview. The government, meanwhile, has only collected $1.6 billion in liability security from companies.

The liabilities include costs that companies must assume to shut down aging and inactive oil and gas exploration wells, facilities and pipelines once they are no longer needed. Another significant part of the liability is the clean-up of toxic tailings ponds from oilsands extraction mines near Fort McMurrray. The ponds have sprawled to cover an area the size of Kelowna.

The tailing ponds are used by companies to dump the waste from the mining of bitumen. The process normally requires hot water to separate bitumen from the oily deposits of sand beneath the boreal forest in Alberta, leaving behind a yogurt-like sludge.

The AER said Wadsworth’s presentation provided “a snapshot in time of estimated total liability” and was based on a “worst-case scenario” of a complete industry shutdown.

This seems to contradict a statement in Wadsworth’s presentation that the estimates are “likely less than the actual cost.” He also warned in his presentation that liabilities from conventional wells were getting larger due to an “increasing number of licensees with questionable financial capacity to meet closure obligations.”

The AER also says that “industry companies are responsible” for the costs in Wadsworth’s estimate.

Lars De Pauw, executive director of the Orphan Well Association — an industry-funded group that assumes responsibility for the inactive wells of bankrupt companies — said the association’s work is getting done this year at a cost that was 30 per cent below the public estimates made by the regulator.

The Canadian Association of Petroleum Producers (CAPP), an industry lobby group that represents most of the country’s oil and gas industry, declined to comment about the estimates from the newly-released documents.

The current rules are so weak that companies can delay setting aside money to cover cleanup costs until they are out of business and can no longer afford to pay anything, Wadsworth explained in his February presentation.

WATCH: Alberta Premier Rachel Notley responds to $260B oilpatch cleanup estimate

“Even though we have known these programs were flawed, there has been no proactive change to the liability programs,” according to speaking notes accompanying the first presentation, delivered on Feb. 28 to the Calgary-based Petroleum History Society. “Until recently, the implications of our flawed system had not been realized.”

National Observer obtained the documents from the February presentation and another Wadsworth gave in June as part of a joint investigation with Global News, the Toronto Star and StarMetro Calgary for the Price of Oil series. The documents were released after a request under freedom of information legislation.

Wadsworth, who previously worked for nuclear power generator Bruce Power, had a 28-year career in the military that included a stint as a colonel in Afghanistan and deployments to Cyprus, Angola, Mozambique and Bosnia, the AER said. His presentation underscored the importance of being transparent with the public about the sector’s liabilities.

“Despite our best efforts, there are liabilities that are no longer owned by a company, or are not addressed by existing liability programs,” Wadsworth’s February presentation said.

“We must ensure that the costs of these liabilities is retained by industry and not passed on to Albertans.”

WATCH: LNG facility in BC good news for Alberta oil and gas

Nearly half of the total estimated liability — $130 billion — is what the AER puts in the “mining” category and involves oilsands and coal mines. Most experts contacted by the Price of Oil team said that this mining amount mostly related to liabilities in the oilsands, especially tailings ponds, with only a small fraction related to coal.

On its website, the regulator says the mining liability in Alberta is right now calculated at about $28 billion, far less than what the regulator’s liability vice president has estimated.

The estimated liability figures are based on the regulator’s internal assessments, while the calculated liability that the public has been told about is based on numbers reported by companies to the AER.

Overall, the province has seen an increasing number of inactive wells becoming “orphans” — wells at the end of their useful lives that need to be cleaned up but no longer have owners who can pay for the job.

In recent years, the number of orphan wells designated for abandonment has climbed from fewer than 800 to more than 2,000, according to industry data. This number appears likely to continue climbing, according to Wadsworth’s presentation. It could take nearly 300 years for the industry to abandon all of its wells, let alone clean them up, the document added.

Wadsworth’s estimates are so high that several experts who reviewed the presentations have described the situation as an economic and environmental crisis that raises questions about the financial health of a province that prides itself on strong fiscal management.

“It’s a big deal,” said Thomas Schneider, an accounting professor at Ryerson University who has tracked liability management issues in the oilpatch for years. “I mean $260 billion is a lot of money… We’re sitting on a huge liability, and then it’s just a matter of who’s going to end up having to pay for it.”

“These are mind-blowing numbers,” said Amin Asadollahi, an environmental consultant who previously worked as a senior policy advisor at Natural Resources Canada. He added that the liability problem needs attention now because the industry will face challenges as some countries try to lessen their dependence on fossil fuels.

“I have never come across anything like this before, where the known risk estimated by decision makers is so much larger than the publicly available estimates,” said economist Robyn Allan, a former president and chief executive officer of the Insurance Corporation of British Columbia who reviewed the presentations.

The numbers come at an awkward time for industry and government officials, who are trying to make the case that they are developing natural resources responsibly and need new pipeline projects such as the Alberta-B.C. Trans Mountain expansion to further expand.

Alberta Environment Minister Shannon Phillips also characterized Wadsworth’s estimates as a “worst-case scenario” in which the industry shuts down overnight.

“The fact is that there are certainly liabilities with orphan wells, with tailings ponds and with other activities on the landscape, but our government from day one has taken these matters seriously and we’ve actually seen pretty good progress on this,” Phillips said. “There’s no question there’s more to do, but we’ve taken it very seriously from the beginning.”

Phillips added that Alberta, ruled by Progressive Conservative governments for 44 years before the New Democratic Party was elected in 2015, had previously failed to take this issue seriously, but that her government was considering whether to force industry to set aside more money as a security deposit.

“We certainly can — that is one of the tools in our toolbox as we review the Mine Financial Security Program (MFSP) and other industry association levies that have to do with (orphan wells.) There is no question that this is an ongoing conversation.”

Schneider, the accounting professor, said the liabilities have the potential to affect Alberta’s balance sheet and its credit rating.

“There’s no way industry could fund that right now,” he said in an interview. “It’s a matter of when are we going to deal with it. Are we going to deal with it now? Are we going to deal with it in 50 years or 100 years? What kind of legacy is going to be left?”

In the presentations, Wadsworth warned that tougher regulations would be needed to prevent the problem from getting worse while ensuring that “we don’t trip economic growth” for a sector that is an important engine in Canada’s economy.

The liabilities are broken down into three categories. After the $130 billion estimated mining liability, the next largest category is the $100 billion cost of cleaning up conventional oil and gas wells. The third group of liabilities, provincially regulated pipelines, came in at about $30 billion, according to Wadsworth’s February presentation.

Phillips, the environment minister, said the solution involves partners at other levels of government, including municipalities, First Nations and the federal government.

“We have a number of liability questions that remain unanswered because this is a long-term problem, and we did not see leadership from the previous government for 44 years,” she said.

“There’s no question that there is more work to be done.”

Editor’s note: This article has been updated to correct an error. Lars De Pauw, executive director of the Orphan Well Association said the association’s work is getting done at a cost that was 30 per cent below public estimates by the regulator, not 70 per cent.

Comments