ESG Performance Metrics in Executive Compensation Strategies

More than three-quarters of companies in the S&P 500 incorporate environmental, social & governance (ESG) performance measures into their executive incentive plans, according to 2024 disclosures, up from two-thirds in 2021. This report analyzes the focus areas and methods of integration of ESG metrics into performance measurement across both the S&P 500 and the Russell 3000.

Key Insights

- Companies continue to link executive compensation to ESG performance despite the recent pushback against ESG, with 77.2% of S&P companies incorporating ESG performance into executive compensation design in 2024, down marginally from 77.8% in 2023.

- ESG measures, particularly strategic scorecards, have seen significant growth, doubling in use across both the S&P 500 and Russell 3000 alongside increased adoption of standalone and individual metrics.

- Human capital management remains the most widely used ESG metric category, while environmental metrics saw rapid growth from 2021 to 2023 before leveling off in 2024 amid growing ESG pushback.

- The use of diversity, equity & inclusion (DEI) metrics declined between 2023 and 2024, although a closer analysis suggests a shift in how DEI is being assessed: moving from individual performance assessments to stand-alone and strategic scorecard measures.

- While growth in the use of ESG metrics in long-term incentives has slowed, growth in their use in a combination of both short- and long-term incentives is increasing.

Executive Rewards Remain Tied to ESG Despite Continuing Pushback

- According to 2024 disclosures, 77.4% of companies in the S&P 500 incorporate ESG performance into executive compensation design, down marginally from 77.8% in 2023. Such metrics are more commonly adopted in some industries than others, and it remains unclear how the change in the US administration will impact attitudes toward ESG outside of the political arena.

Although very small, the drop in the use of ESG performance metrics in compensation design in the S&P 500 may indicate a slowing trend in the use of such metrics at the largest companies in light of ESG backlash. Companies in two of the three largest revenue brackets ($10 billion– $24.9 billion and $50 billion and over) drove the slight decrease, with companies in the second-largest asset value bracket, $50 billion–$99.9 billion, also seeing a decline. In contrast, although lower overall, the use of ESG metrics is increasing in the Russell 3000, from 44.3% to 46.5% between 2023 and 2024 disclosures.

There are significant differences in adoption across industries. Just over a third of companies in communications services, consumer staples, and health care use ESG metrics, while less than a third of information technology companies do. In contrast, almost 90% of utilities companies use them, and around two-thirds of energy, real estate, and materials companies.

ESG Performance Metrics: Integration TypesOur analysis distinguishes between three types of use of ESG performance metrics:

|

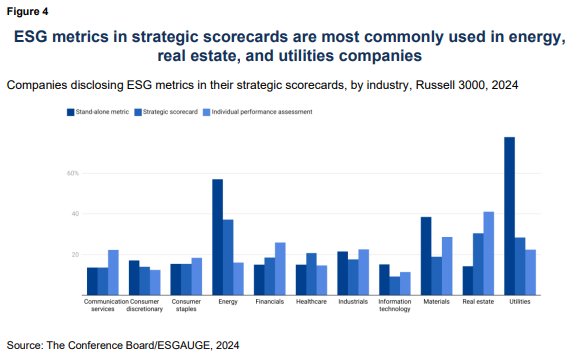

2024 Saw Significant Growth in the Use of ESG Metrics in Strategic Scorecards in Some Industries

- Of the three types of ESG performance metric integration, strategic scorecards have seen the largest increase in use in both the S&P 500 and the Russell 3000, with adoption nearly doubling in both indexes since 2021 disclosures. However, this increase was not seen evenly across all industries; information technology and communications services saw little increase, while the practice is well-established among energy companies.

While the use of ESG metrics as a stand-alone performance measure has increased by 10 percentage points in the S&P 500 and by 3 percentage points in the Russell 3000 since 2021, their use in individual performance assessments fell slightly in the S&P 500 and remained basically flat in the Russell 3000. In contrast, their use in strategic scorecards almost doubled in both indexes between 2021 and 2024, from 21.1% to 39.1% in the S&P 500 and from 10.2% to 18.8% in the Russell 3000. The distinct options for incorporating ESG metrics now stand at similar levels across all three types, indicating that companies are open to different approaches. In addition, the proportions using these different approaches generally exceeds 100%, as companies often use multiple integration types depending on the ESG metrics in question.

For example, in both the S&P 500 and the Russell 3000, emissions reduction and DEI metrics are both more commonly measured using a strategic scorecard approach, while customer satisfaction and employee health and safety metrics are more commonly included as a standalone metric, and cybersecurity is most commonly an individual performance assessment. These findings reflect executive-specific and company-wide responsibilities.

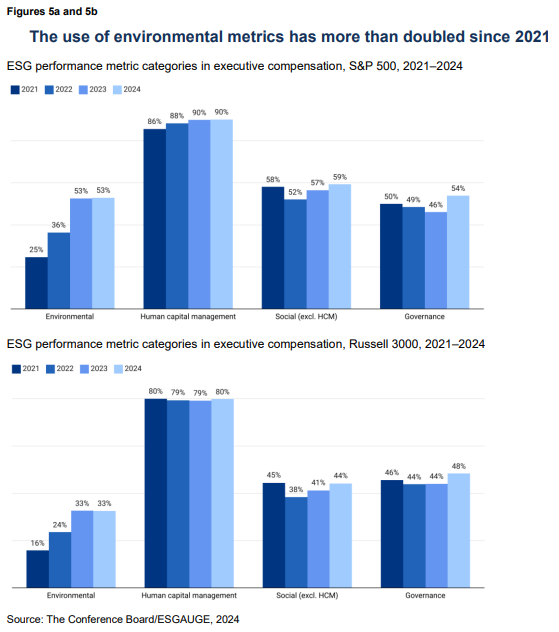

The Spread of Environmental Metrics Plateaued in 2024 Following a Period of Rapid Growth

- While nine-tenths of the S&P 500 and four-fifths of the Russell 3000 companies that integrate ESG performance metrics use human capital management (HCM), the fastest-growing category between 2021 and 2023 was environmental, which more than doubled in use in both indexes. However, growth of “E” metrics stalled in 2024, while the adoption of governance and social metrics increased.

HCM remains the most prevalent ESG metric category, with 90% of S&P 500 companies and 80% of Russell 3000 companies that report ESG metrics including it. HCM metrics cover DEI— the most common—along with employee engagement, health and safety, pay equity, recruitment, retention and turnover, and talent development.

Outside of HCM, the adoption of environmental metrics stabilized across both indexes in 2024 after significant growth from 2021 to 2023. This earlier growth likely reflected increased focus on environmental issues, particularly climate change, while the 2024 plateau may indicate both a maturing of these efforts and a recalibration of corporate approaches to climate change following persistent ESG pushback. The most common environmental metric, by a significant margin, relates to emissions and carbon reduction.

Environment-related ESG performance metrics are especially prevalent in the energy (78%), utilities (68%), and materials (61%) sectors, likely due to the direct impact of these industries on environmental outcomes and heightened regulatory and stakeholder expectations in these areas.

Social (excluding HCM) and governance metrics have held steady since 2021. In 2024, however, governance-related metrics saw a significant increase of 8 percentage points from 2023 among S&P 500 companies using ESG performance metrics, indicating a potential heightened emphasis on governance issues within larger firms. S&P 500 companies saw particularly notable increases in the use of “G” metrics for audit and risk oversight (7% to 10.5%), cybersecurity (9.3% to 11.9%), and shareholder engagement (2.3% to 7.8%).

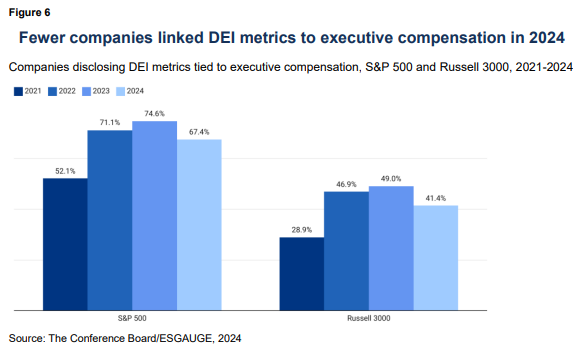

The Prevalence of DEI Metrics Decreased Slightly in 2024, Although the Underlying Picture Is Nuanced

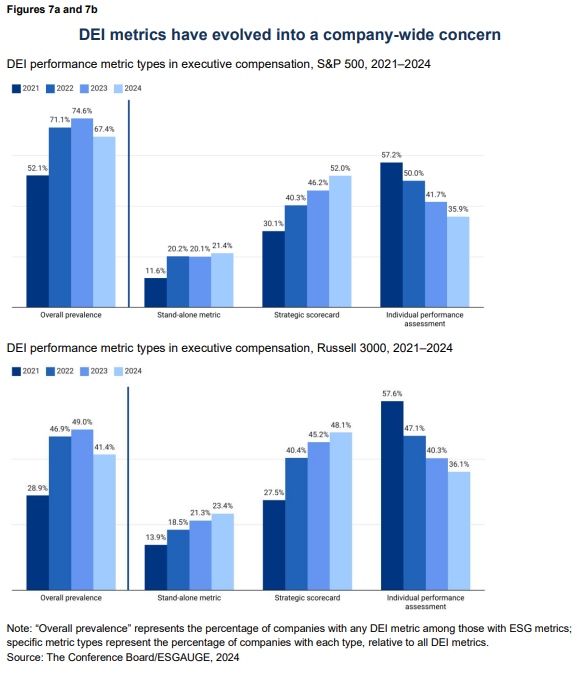

- The use of diversity, equity & inclusion (DEI) metrics fell between 2023 and 2024 in both indexes. However, a closer look at how DEI is measured indicates a shift in approach from individual performance assessments to stand-alone and strategic scorecard measures, which may reflect a maturing of corporate DEI efforts.

The percentage of companies incorporating specific DEI metrics into executive compensation notably dropped between 2023 and 2024, declining from 74.6% to 67.4% in the S&P 500 and from 49.0% to 41.4% in the Russell 3000. This decline reverses the trend of rapid adoption seen after 2021 and may reflect recent heightened scrutiny of corporate DEI initiatives.

A deeper analysis of how companies integrate DEI metrics into compensation reveals a more nuanced and complex landscape. The incorporation of DEI metrics as stand-alone performance indicators and strategic scorecard targets has increased in the S&P 500 since 2021, rising from 11.6% to 21.4% for stand-alone metrics and from 30.1% to 52.0% for scorecard metrics. Similar growth rates were evident in the Russell 3000. Over the same period, there was a corresponding drop in both indexes of their use as individual performance measures, from around 57% to around 36% over the same period. The decrease in such metrics as individual performance measures (typically for roles such as chief human resources officer, chief diversity officer, or business unit leader) may indicate that accountability is shifting from individual leaders to a broader, enterprise-wide commitment that is more measurable and strategically aligned.

2024 Saw Some Growth in the Use of ESG Metrics in a Combination of Short- and Long-Term Incentives

- Although the use of ESG metrics in short-term incentives far exceeds their use in long-term plans, combined annual and long-term incentive plans are seeing a slow rise in adoption of these metrics. This may indicate a shift toward embedding ESG considerations into broader and more strategic aspects of executive compensation.

ESG metrics are primarily applied to annual incentive plans that focus on short-term results within a one-year period—85.8% in the S&P 500 and 89.8% in the Russell 3000 in 2024— although this exclusive focus on short-term plans is gradually declining. The corresponding growth has been in the proportion of companies that use ESG metrics for both annual and longterm incentive plans, from 7.2% to 12.3% in the S&P 500 and from 5.3% to 7.8% in the Russell 3000, indicating a trend toward integrating ESG into broader strategic horizons. There are some industry differentials, however, with 37.9% of utility companies now applying ESG metrics to both annual and long-term plans, far ahead of any other industry. However, use in long-term incentive plans alone has remained steady at around 2% for both indexes.

The limited adoption of ESG metrics in long-term incentive plans reflects challenges in setting credible long-term targets, including data limitations, evolving ESG criteria, and potential misalignment with traditional financial goals. However, as companies enhance ESG data collection and analytics capabilities and respond to expanding mandatory sustainability reporting requirements in the US and internationally, the integration of ESG metrics into long-term plans may increase.

About This Report and TCB Benchmarking

The Conference Board, in collaboration with ESG data analytics firm ESGAUGE, tracks the use of ESG performance metrics in the executive incentive plans of US public companies. Our live, interactive dashboard documents trends and developments in senior management compensation at companies issuing equity securities registered with the US Securities and Exchange Commission (SEC). The dashboard covers eight key areas: 1) CEO compensation elements; 2) NEO compensation elements; 3) annual incentive plan design; 4) long-term incentive plan design; 5) ESG performance metrics; 6) pay versus performance; 7) CEO pay ratio; and 8) say-on-pay votes.

The data presented in this report were derived from the database on November 8, 2024, and reflect disclosures by Russell 3000 and S&P 500 companies in their proxy statements’ Compensation Discussion and Analysis (CD&A) section. Data for 2024 are compared with the disclosures made in the previous three years. To provide additional insights, the analysis extends to data cuts by 11 Global Industry Classification Standard sectors and 14 company size groups (by annual revenue and asset value). The research is conducted by The Conference Board and ESG data analytics firm ESGAUGE, in collaboration with executive compensation consulting firm FW Cook.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE. Visit conferenceboard.esgauge.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release