Claudia Buch, Isabel Schnabel: Managing liquidity in a changing environment

18 March 2025

By Claudia Buch and Isabel Schnabel

As the normalisation of the Eurosystem balance sheet progresses, the aggregate amount of central bank liquidity available to banks in the euro area will fall over the coming years. This blog explains the role played by the Eurosystem’s refinancing operations within the operational framework for monetary policy implementation. The ECB, both as a monetary policy authority and as a supervisor, expects that banks should consider these operations as an integral part of their day-to-day liquidity management.

In their day-to-day liquidity management, banks need to be able to meet their cash-flow obligations by having sufficient liquid assets or by sourcing short-term funding. The amount of liquidity they need is uncertain as it is affected by external shocks and the behaviour of others, such as depositors or market participants. Central bank reserves are the ultimate liquid asset. Banks can obtain reserves from other banks without, however, affecting the total amount of reserves in the system. They can, for instance, borrow in money markets (changing their funding composition) or sell assets (changing their asset composition). At a system-wide level, banks can source additional reserves only from central banks – for example, in the euro area, by using the standard refinancing operations.

The European banking system is currently operating with a high level of excess liquidity, that is to say, reserves in excess of applicable minimum reserve requirements. This high level of excess liquidity reflects the ample provision of liquidity through earlier monetary policy measures, most importantly quantitative easing, during the low interest rate period before and during the COVID-19 pandemic. Hence, there is currently little need for additional reserves, implying only low demand for liquidity in the ECB’s regular refinancing operations.

Since late 2022, however, in line with the change in the monetary policy regime, excess liquidity has progressively declined, mainly reflecting the maturing of targeted longer-term refinancing operations (TLTROs). As a result, banks have started to tap funding markets as a source of liquidity and have visibly increased their activity in repo markets.[1]

Over the coming years, the reduction of the Eurosystem monetary policy portfolios will further lower the amount of excess liquidity available to banks in the euro area. To manage this transition from abundant to less ample excess liquidity, in March last year the Governing Council adopted a new operational framework for monetary policy implementation.

This blog post explains the role that the Eurosystem’s refinancing operations play within the ECB’s operational framework. It emphasises that, as excess liquidity becomes less ample, the ECB, both as a monetary policy authority and as a supervisor, expects that banks should consider these operations as an integral part of their day-to-day liquidity management.

Banks’ demand for reserves

For most of the past ten years, banks in the euro area operated in an environment in which the ECB was injecting abundant liquidity into the financial system in pursuit of its price stability mandate – similar to the situation in many other parts of the world.

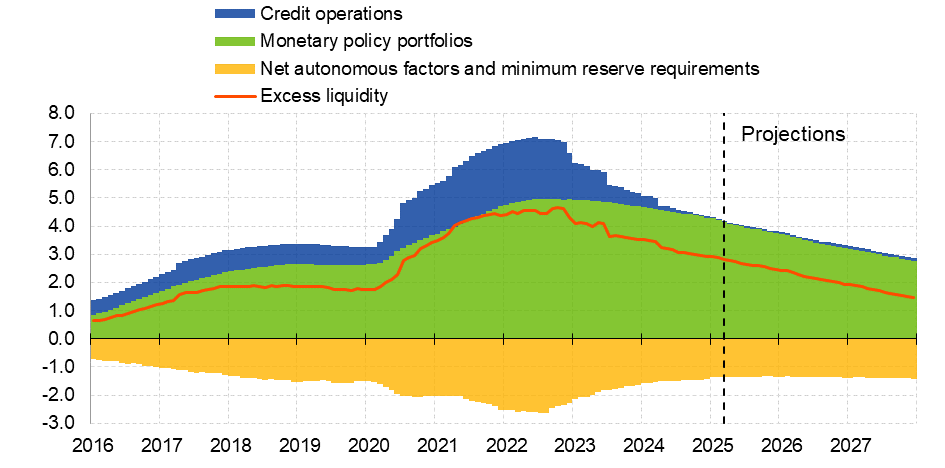

When inflation surged following the pandemic and the Russian invasion of Ukraine, the ECB responded forcefully by raising interest rates sharply and starting to normalise its balance sheet. Excess liquidity has declined visibly since then as banks repaid their TLTROs and the ECB’s monetary policy portfolios are being gradually rolled off (Chart 1).

At its peak in November 2022, excess liquidity in the euro area reached €4.7 trillion, or 14% of euro area banks’ total assets. Today, excess liquidity stands at €2.8 trillion (8.5% of total assets), and it is expected to fall further over the coming years.[2]

Chart 1

Eurosystem balance sheet: actual and projected

(EUR trillions)

Sources: ECB and ECB calculations.

Notes: Monetary policy portfolios and credit operations are assumed to develop in line with the median expectations of analysts as reported in the latest Survey of Monetary Analysts. The projection of banknotes is based on ECB internal models.

As excess liquidity declines, it will eventually no longer be sufficient to meet the banking system’s demand. This demand is determined by the public’s cash withdrawals, banks’ payment needs and liquidity preferences, as well as by prudential liquidity regulation. It is inherently difficult to predict when the turning point for excess liquidity will happen. Banks are currently operating in an environment characterised by a high degree of uncertainty,[3] making it more difficult to predict future cashflows and banks’ desired level of reserves. Banks’ demand for liquidity is also affected by the growing relevance of non-bank financial intermediaries in the financial system as both customers and competitors. And the accelerating pace of digitalisation and the growing demand for instant payments may alter depositor behaviour.

These factors are likely to drive up the precautionary demand for liquidity relative to the time before the abundant liquidity regime was introduced, and they contribute to uncertainty around the demand for central bank reserves.[4] The precautionary demand is possibly augmented by investors expecting banks to maintain a certain level of liquidity buffers above the regulatory minimum.

The ECB’s operational framework

Overall, it has become more difficult for central banks to correctly anticipate the demand for reserves and, hence, to steer interest rates in a wide interest rate corridor, as was the case when the ECB was still operating in a scarce liquidity regime.

Against this backdrop, in March 2024 the ECB Governing Council announced changes to its operational framework[5] to ensure the smooth implementation of monetary policy.

The operational framework has three key characteristics.[6]

The first is that the marginal unit of central bank liquidity is provided on demand through the ECB’s refinancing operations. To this end, the Governing Council decided that the standard refinancing operations – the one-week main refinancing operations and the three-month longer-term refinancing operations – will continue to provide as much liquidity as banks demand at a fixed rate and against a broad set of collateral.

The new framework implies that the amount of excess liquidity will be determined by banks themselves through their decisions to use the central bank’s lending operations. This marks a significant change from the recent past when reserves were mainly created by the central bank through asset purchases.

By allowing banks to borrow the liquidity they need against a broad set of eligible collateral, the current operational framework is also fundamentally different from the times when the ECB operated under a scarce liquidity regime.

The second key characteristic is the mix of instruments used to supply reserves. Banks are likely to hold high levels of central bank reserves on a permanent basis. As such, it is not sufficient to rely entirely on short-term lending operations to satisfy banks’ reserve demand as this would imply continuously rolling over large volumes of lending operations.

Therefore, once the Eurosystem balance sheet begins to durably grow again, the ECB will also start supplying reserves through structural longer-term refinancing operations and a new structural bond portfolio, taking legacy bond holdings into account.

These operations will make a substantial contribution to covering the banking sector’s structural liquidity needs arising from autonomous factors and minimum reserve requirements. But the marginal unit of liquidity will continue to be provided by the standard refinancing operations.

The third characteristic of the operational framework is that monetary policy is implemented through a “soft” floor with a relatively narrow spread of 15 basis points between the rate on the main refinancing operations and the deposit facility rate. This will limit the potential upward pressure on money market rates as the ECB’s balance sheet normalises. It will make accessing ECB operations economically attractive, also given that banks can pledge non-high-quality liquid assets as collateral.

At the same time, the spread is large enough to preserve incentives for money market activity by encouraging banks to manage their liquidity prudently, thereby avoiding the risk of excessive liquidity transformation through the ECB’s balance sheet, especially in light of the broad collateral framework.

Navigating the new normal

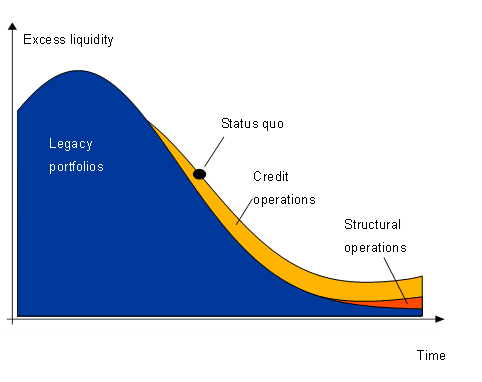

The ECB’s operational framework therefore relies on the banking system eventually replacing the reserves that will be absorbed through the run-down of the ECB’s bond holdings by borrowing in regular refinancing operations (Chart 2). The structural operations will be conducted only at a later stage.

Chart 2

Stylised breakdown of reserve supply over time

Source: ECB.

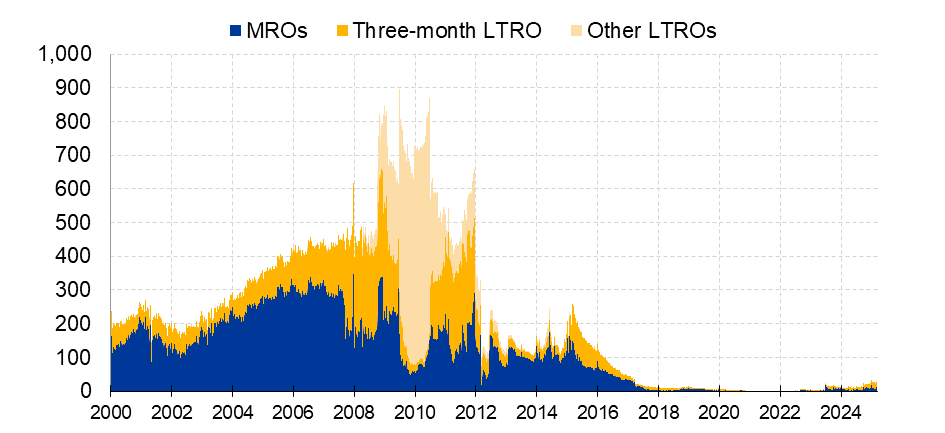

This is not the first time that the ECB has given refinancing operations a central role in the implementation of monetary policy. Under the scarce reserve regime in place in the early years of the euro, banks regularly tapped the Eurosystem’s refinancing operations for large amounts, in some periods reaching about €450 billion (Chart 3).

Chart 3

Euro area banks’ use of standard refinancing operations

(EUR billions)

Source: ECB and ECB calculations.

Notes: “MROs” refers to one-week liquidity-providing operations in euro. “Three-month LTROs” refers to three-month liquidity-providing operations in euro. “Other LTROs” refers to one-month, six-month and 12-month liquidity-providing operations in euro. The latest observations are for 10 March 2025.

So banks making greater use of monetary policy operations over the coming years will not be a symptom of liquidity stress. Rather, it will simply reflect their day-to-day liquidity management in the context of the operational framework.

Indeed, one of the strengths of the framework is that all banks in the euro area, regardless of their business model, size and geographical location, can hold the amount of reserves they find optimal, thereby insuring against risks of fragmentation in euro area money markets and sudden liquidity imbalances.[7]

And when banks replenish shortfalls in their desired level of reserves by accessing ECB operations, the total amount of liquidity in the system will be such that the ECB can steer short-term money market rates towards the key policy rate without having to know banks’ desired level of excess reserve holdings.

Refinancing operations also play a central role from a supervisory perspective. In the new normal, standard refinancing operations are seen as a routine and integral component of banks’ day-to-day liquidity management, and they will constitute an important part of a diversified funding mix. This should also be taken into account by bank boards, credit rating agencies and other authorities such as foreign supervisors.

From a supervisory perspective, banks are expected to proactively take forthcoming changes in liquidity and bank funding conditions into consideration. They need to be prepared to operate in an environment of less ample excess liquidity and be ready to source central bank reserves in a swift and scalable manner from a broad range of sources, both from the central bank as well as in money markets.

In this context, it is essential that banks are prepared on an operational level. This entails a robust IT infrastructure that allows them to identify and swiftly mobilise eligible collateral. Banks also need to set up the necessary organisational and contractual arrangements to access monetary policy operations and market counterparties. Moreover, they need to be in a position to prudently plan their liquidity needs.

On all these aspects, the targeted reviews we performed in 2024 to tackle shortcomings in asset and liability management frameworks show that banks still have room for improvement.[8] For example, some banks were not able to determine the eligibility of a material share of their assets. In the same vein, shortcomings were noted in the design, implementation and governance of funding plans, as well as in the integration of monetary policy operations into the overall liquidity management framework.

Conclusion

Successfully transitioning to a monetary policy implementation framework where the marginal unit of central bank liquidity is provided on demand through the ECB’s refinancing operations requires that banks actively and routinely access Eurosystem standard refinancing operations in order to secure a sufficient level of central bank reserves not only individually, but also in the banking system as a whole. Banks’ increasing use of ECB operations will reflect their day-to-day liquidity management in the context of the operational framework.

For this to function smoothly, banks need to ensure that they are operationally ready for the change in how central bank reserves are provided. It is essential that they adjust their liquidity management practices and are ready to access monetary policy operations. The ECB will continuously monitor progress in this area and communicate its expectations to monetary policy counterparties and supervised banks.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release